Cost or expense reconciliation is the process of carefully scrutinizing a statement or document that provides suitable adjustments that match the financial report of each department. Cost reconciliation allows organizations to ensure accuracy and consistency in their company-wide cost management processes. Consolidated direct operating expenses increased $29.7 million, or 7.8%, during the three months ended September 30, 2024 compared to the same period of 2023. The increase was primarily driven by higher variable content costs, including higher third-party digital costs and podcast profit sharing expenses related to the increase in digital revenues. Incorporating these strategies into your reconciliation process not only simplifies the task but also enhances the accuracy and efficiency of your financial management.

How often to reconcile accounts

This involves gathering required information from multiple teams, inputting data, generating and editing reports and circulating regular reports to the relevant stakeholders. Many construction companies build their CVR reports in Microsoft Excel, which relies on manual data entry, which in turn increases the risk of human error in the process. These errors can lead to miscalculations and incorrect costings later down the line with final reports.

Module 7: Costing Methods

- Accuracy and strict attention to detail are crucial to any account reconciliation process.

- Once you’re confident in the accuracy of your report, save it in a secure location.

- The next step is to identify and compare the possible solutions to resolve the inconsistencies.

- In addition, we believe that Free Cash Flow helps improve investors’ ability to compare our liquidity with that of other companies.

- All of our content is based on objective analysis, and the opinions are our own.

Whether you have high transaction volumes or complex transaction scenarios, Stripe’s reconciliation solution offers scalable and reliable support for your financial operations. These practices contribute to reliable financial reporting, household employment taxes which is integral to almost every aspect of operating and growing a business. To reconcile their costs, small businesses should compare and analyze the variances between the actual costs and the budgeted or estimated costs.

How is CVR carried out in Construction?

Automatically calculate and update CVR and produce CVR reports at the click of a button with Access Coins, the ERP built for construction. By validating data quality early on, companies can save time and money down the road while remaining agile enough to meet ever-evolving demands in the modern age. Additionally, relying too heavily on an automated system can mean that financial teams lack understanding of the data they review or report on which could further complicate things. Time is conserved that can instead be devoted to creative processes, such as strategizing cost-structure alignments or tapping into opportunities for more cost-effective solutions. Irrelevant data being mixed, data that is incomplete or with a wrong date, formatting errors, and incorrect synthesis of numbers. As of September 30, 2024, the Company had $5,221.8 million of total debt and $4,790.1 million of Net Debt.

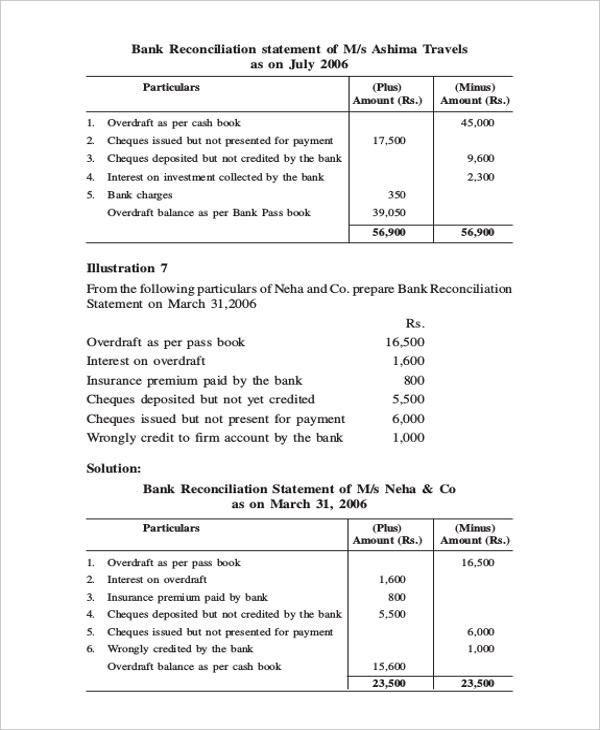

These techniques involve meticulous analysis and comparison of different datasets. For instance, when identified discrepancies are corrected, it leads to more reliable financial statements, which are crucial for internal decision-making and communications with stakeholders, such as investors or auditors. Additionally, cost reconciliation can help identify areas where overspending occurs, leading to better budgeting practices. Reconciliation processes present a challenge to businesses as they seek to make sure both financial accounts are. Errors in cost and financial accounts can have serious consequences, especially when it comes to net profit.

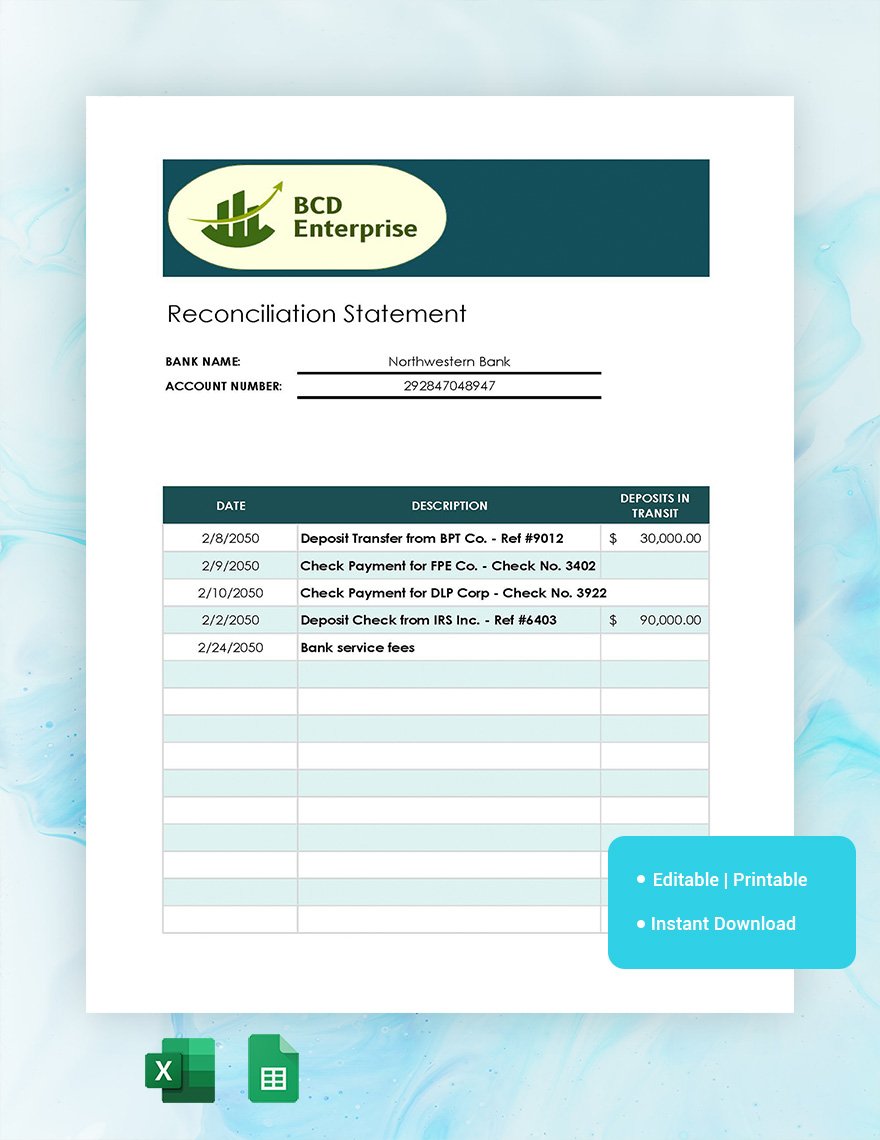

The process of ensuring that balance sheet accounts are set up correctly can help you a lot. Reconciliation in accounting is the process of making sure all the numbers in your accounting system match up correctly. For example, when reconciling your bank statement with your company’s ledger, bank reconciliation means comparing every transaction to make sure they match. This practice helps identify and rectify discrepancies, including missing transactions. In essence, reconciliation acts as a month-end internal control, making sure your sets of records are error-free.

The terms of our capital structure include no material maintenance covenants, and there are no material debt maturities prior to May 2026. Capital expenditures for the nine months ended September 30, 2024 were $72.2 million compared to $90.4 million in the nine months ended September 30, 2023. Capital expenditures during the nine months ended September 30, 2024 decreased primarily due to lower spending on real estate optimization initiatives. Certain prior period amounts have been reclassified to conform to the 2024 presentation of financial information throughout the press release. Broadcast revenue declined $6.3 million, or 1.4% YoY, driven by lower spot revenue, partially offset by an increase in political advertising and non-cash trade revenues. Revenue from Sponsorship and Events increased by $0.8 million, or 1.7% YoY.

The first step in bank reconciliation is to compare your business’s record of transactions and balances to your monthly bank statement. Make sure that you verify every transaction individually; if the amounts do not exactly match, those differences will need further investigation. These different types of reconciliation are important for maintaining accurate financial records, detecting errors and fraud, and ensuring the reliability of the accounting system.

If a company’s financial accounts do not accurately reflect its revenue and expenses, then its net profit will be wrong too. Thirdly, account reconciliation is vital to ensure the validity and accuracy of financial statements. Individual transactions are the building blocks of financial statements, and it is essential to verify all transactions before relying on them to produce the statements.

Be the first to post a comment.