Instead of hastily attributing it to a revenue or liability account, the amount is placed in a suspense account. This ensures that the company’s financial statements remain unblemished by inaccuracies while the necessary investigation is conducted to ascertain the nature of the transaction. A suspense account is a temporary account used in the general ledger to hold transactions that require further investigation to determine their proper classification. It is not specific to any one type of balance and can contain both debits and credits depending on the nature of the transactions it holds.

- The suspense account is used because the appropriate general ledger account could not be determined at the time that the transaction was recorded.

- The rules that mortgage servicers must follow are spelled out by the Consumer Financial Protection Bureau, which enforces the federal Real Estate Settlement Procedures Act.

- Ideally, a business will have a zero balance in the suspense account—or no suspense account listed—in its financial statements.

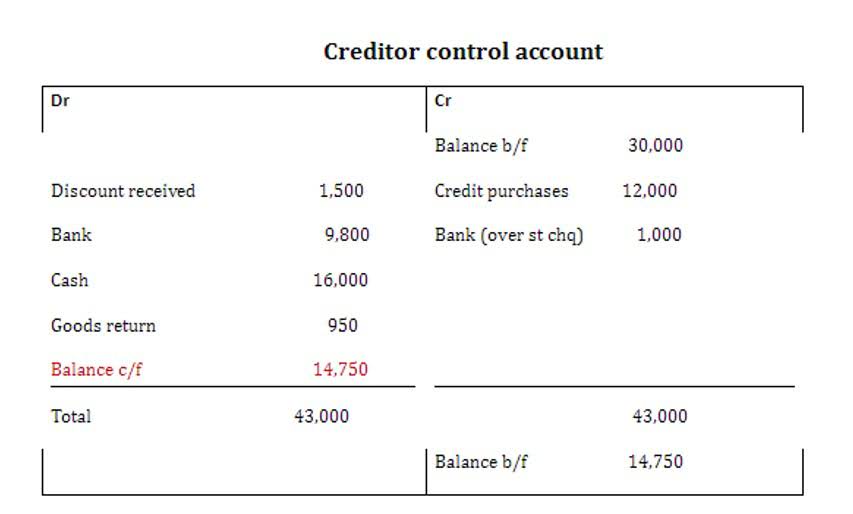

- When the trial balance shows credits exceeding debits, the difference should be recorded as a debit to reflect the temporary nature of those funds.

- Any balance is investigated so that correcting adjustments can be made before the final financial statements are issued.

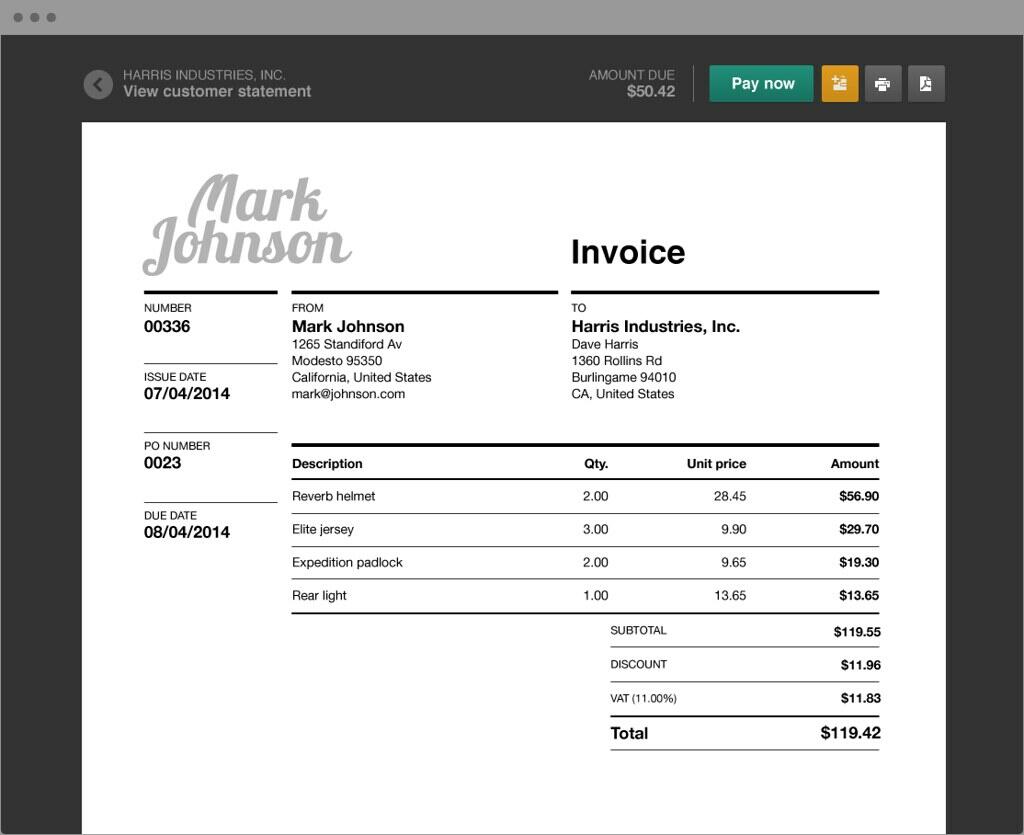

- For example, an entry for a payment will be cleared from the suspense account and entered into the accounts receivable once the corresponding invoice has been identified and the details about the transaction are known.

Transform your Record-to-Report processes with HighRadius!

Later, the entries can be transferred to the relevant accounts at the appropriate ratio. One important use of a suspense account is to bring the trial balance into agreement. Identifying an amount shouldn’t be an impossible task (if so, it may suggest fraud). Remember to consider issues like an inaccurate recording of funds (for example, money going into the cash account and not the sales account) and unrecorded expenses, which can be traced back to their invoices.

Interested in automating the way you get paid? GoCardless can help

- When a transaction with no valid document is recorded, it causes a mismatch in the account balances.

- A trial balance is the closing balance of an account that we calculate at the end of the accounting period.

- For the past 52 years, Harold Averkamp (CPA, MBA) has worked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online.

- There are several errors that may be revealed by the trial balance which involve the suspense account.

- Use a suspense account when you buy a fixed asset on a payment plan but do not receive it until you fully pay it off.

For example, the periodic account statements that servicers are responsible for providing to borrowers must indicate any payments that have been put into a suspense account and the total amount of money in that account. The servicer must also explain what the borrower needs to do in order to have that money applied to their mortgage payment. The term “suspense account” can have several different meanings, depending on the context. In the business world generally, a suspense account is a section of a company’s financial books where it can record ambiguous entries that need further analysis to determine their proper classification. In a locked box scenario, buyers face the risk of a disconnect between the purchase price and the value of the company at completion. It is critical to achieve satisfactory (particularly financial) due diligence results prior to signing.

When to use suspense accounts

The suspense account can hold the difference that led to the trial balance not balancing until the discrepancy is rectified. The unclassified transactions temporarily “parked” in this account are a “suspense” that we need to investigate and relocate into their correct accounts accordingly. At times, all the required details for a particular transaction are not available but it still needs to be recorded in order to keep the https://www.bookstime.com/ accounting books updated.

- In balance sheet terms, a suspense account is not ideal, as it can prevent you from accurately balancing the books.

- By providing a detailed trail of records for each transaction, including the date, time, and user information, it supports organizations during audits.

- Otherwise, combining the payments with an existing fixed asset would distort the value of that asset.

- A suspense account is the general ledger account that the company uses for recording transactions temporarily.

Usage: What Are Suspense Accounts Used For?

It can highlight areas where financial processes may be improved to prevent similar occurrences in the future. For instance, if certain types of transactions frequently end up in suspense accounts due to ambiguous documentation, this could indicate a need for clearer invoicing procedures or more detailed payment forms. By addressing these procedural gaps, organizations can reduce the volume of suspense account transactions that require suspense account classification, streamlining accounting operations and enhancing overall financial management. Here are four common scenarios where suspense accounts are utilized, each presented with detailed journal entries to illustrate the proper accounting practices. When you receive the full payment from the customer, debit $50 to the suspense account. This closes the suspense account and moves the payment to the correct account.

Then, we close the account after making the necessary adjustments so that it’s no longer part of the trial balance. Much like the other types of suspense accounts, the suspense accounts at brokerage firms are used to hold funds temporarily while transactions are cash flow being completed. A suspense account may also be established if further information is needed to finalize the transaction or if there are other complications that need to be resolved.

Our Services

A suspense account cannot have a debit balance, it always shows a credit balance. Later, when they receive more information, they can transfer the entry from the suspense account to the correct account. Let’s say you receive money from a customer called John for delivering him goods without an invoice. If there is credit balance in suspense a/c, it is shown on asset side of balance sheet. The difference amount is temporarily recorded in a suspense a/c and should be cleared at some point as it possesses a control risk.

Be the first to post a comment.