This eliminates the use of inventory layering or weighted averaging, which are quite common when large numbers of the same items are stored on the premises. A major advantage of the specific identification method is the high degree of accuracy when calculating the cost of inventory. The exact cost at which something was purchased is recorded in the inventory records and charged to the costs of goods sold when the related item is sold.

Understanding the Specific Identification Method for Inventory Valuation

Each car has a different dealer cost and a different sales price based on the model and its features. Each of the cars is tracked individually from the time they enter the lot until they are sold. Tracking the cost of each item is crucial for businesses managing expensive equipment. They might label each machine with a serial number and record its purchase price, maintenance costs, and depreciation over time.

Understanding the Specific Identification Method in Inventory Accounting

In practice, this means a company’s financial statements reflect the true value of each piece of equipment. Accurate accounting aids in creating reliable reports for investors, tax authorities, and internal management reviews. It thrives in environments rich with distinct, high-value products, seamlessly aligning actual costs with their respective units to ensure meticulous financial reporting and control. You must specify the lot to sell before executing the sale, and the broker must confirm those instructions in writing at that same time. You cannot decide to use SI after the sale’s settlement date, like when preparing your tax returns. The IRS provides a little leeway to correct communication errors with the broker by allowing a settlement date rather than a trade date.

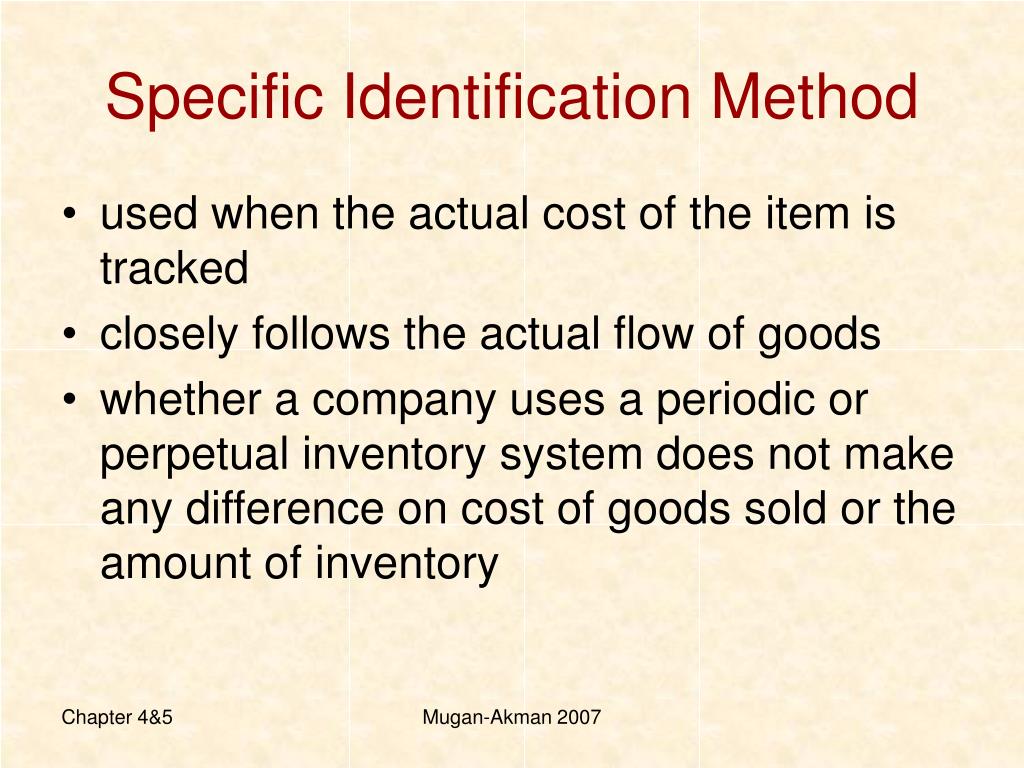

- The cost of goods sold (COGS) and cost of ending inventory are determined by the actual cost assigned to each physical unit of inventory.

- Andy Smith is a Certified Financial Planner (CFP®), licensed realtor and educator with over 35 years of diverse financial management experience.

- The specific identification inventory valuation method is a system for tracking every single item in an inventory individually from the time it enters the inventory until the time it leaves it.

- It can be more complex because it requires detailed tracking of individual items in inventory.

- This method ensures detailed financial outcomes but requires meticulous record-keeping and can be subject to profit manipulation.

Example of Specific Identification Inventory Method

We have 20 of the red (Nov. 15) batch left, and three of the green (Oct. 15) batch left. So far we’ve purchased 35 bats and we’ve sold 12, so there should be 23 bats on hand in the store. Let’s assume we’ve not lost any to “shrinkage” (breakage, customer theft, or employee theft) and that our perpetual records match our physical count. At tax time, using the method described above, the investor can easily match up the shares sold for $70 with the most expensive of the shares purchased (for $60 per share).

How can businesses address the challenges of the Specific Identification Method?

This guide discusses how the specific identification inventory method works, who it’s optimal for, its highlights and drawbacks, and how to calculate ending inventory and COGS using it. Because I know the specific units being sold, I can use the specific identification method. Notice this system is exactly the same as if the company was using the periodic system because, under specific identification, we are assigning costs to individual units as they are sold. It can be more complex because it requires detailed tracking of individual items in inventory. Companies often use this method for expensive or unique items where tracking individual costs makes sense.

FIFO Vs. Specific Identification Accounting Methods

When the inventory arrives, each piece is matched the invoice to allocate the cost. The specific identification of inventory methods, or SI Method, is where we specifically identify which items of inventory has been sold. This means that we can expense the exact cost of the item being sold. Through this post, we’ll guide you step-by-step through understanding how this method works to ensure your inventory valuation is spot-on. We’ll unravel the complexities of tracking individual costs and show how this could benefit your bottom line.

It requires tight record-keeping but gives accurate financial numbers. Making smart choices in inventory tracking boosts success and keeps taxes in check. Keeping track of every item’s real cost is at the heart of precise inventory management. Each camera has different features, making them unique and their costs vary widely. Art galleries might sell a painting and record exactly what they bought it for; jewelers do the same with rings or necklaces. They keep detailed records so financial statements reflect true costs and profits, which is important for taxes too.

A purchase updates both the general ledger (GL) and the subsidiary ledger. Thus the value of the cost of goods sold for August 2019 is $ 1,315. Match cost to sales – This is done while calculating the COGS the cost and revenue is matched for each product.

Companies that deal with high-value items such as jewelry, handicrafts, etc., mainly use this method as it keeps a record of each of such items having high value. Our bookkeeping guide discusses how inventory tracking relates to the whole bookkeeping process. The ______ ______ Method involves tracking the cost of each inventory item through unique identifiers. As a sale where do i enter schedule c occurs COGS or cost of goods sold is charged with the actual or invoice cost leaving the actual cost of inventory on hand still in the inventory account. Say an investor owns 1,000 shares of ABC company, a volatile small-cap manufacturer. It includes 400 shares purchased for $40 per share, 300 shares at $60 per share, and the remaining 300 shares at $20 per share.

Enables precise COGS calculation by tracking individual item costs. Uses unique identifiers like serial numbers for precise cost tracking of each inventory item. This system is extremely accurate because each piece of inventory can be tracked separately. There are no estimates involved which make the inventory and cost of goods sold numbers more accurate on the financial statements as well. Delta company is selling items of inventory that cost us 25 a piece to bring them in.

Be the first to post a comment.