Revenue may be earned by providing goods or services as well as earnings from investments. In short, revenue is the generation of wealth for the owners, and therefore increases owners’ equity, while expenses are the consumption of resources, and therefore decrease owners’ equity. For instance, one of the most common accounts is the company checking account. Transactions such as paying bills decrease this account and making deposits increases the account. Assume an ending balance of $1,000 from last month in your company checking account. When you write a check for rent in the amount of $110, you subtract that from the balance.

Module 4: Financial Statements of Business Organizations

A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation. Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice.

Expense accounts

All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. 11 Financial is a registered investment adviser located in Lufkin, Texas. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements.

- Having a strong, working understanding of the different types of accounts in accounting is the best and only way to ensure a smooth accounting system for your business.

- (1) Applicability of the Accounting Standards to Large Non- company entities.

- What’s more, they are often customized to fit the business owner’s specific needs.

- Further, they have different results as well as recording and maintenance.

Do you already work with a financial advisor?

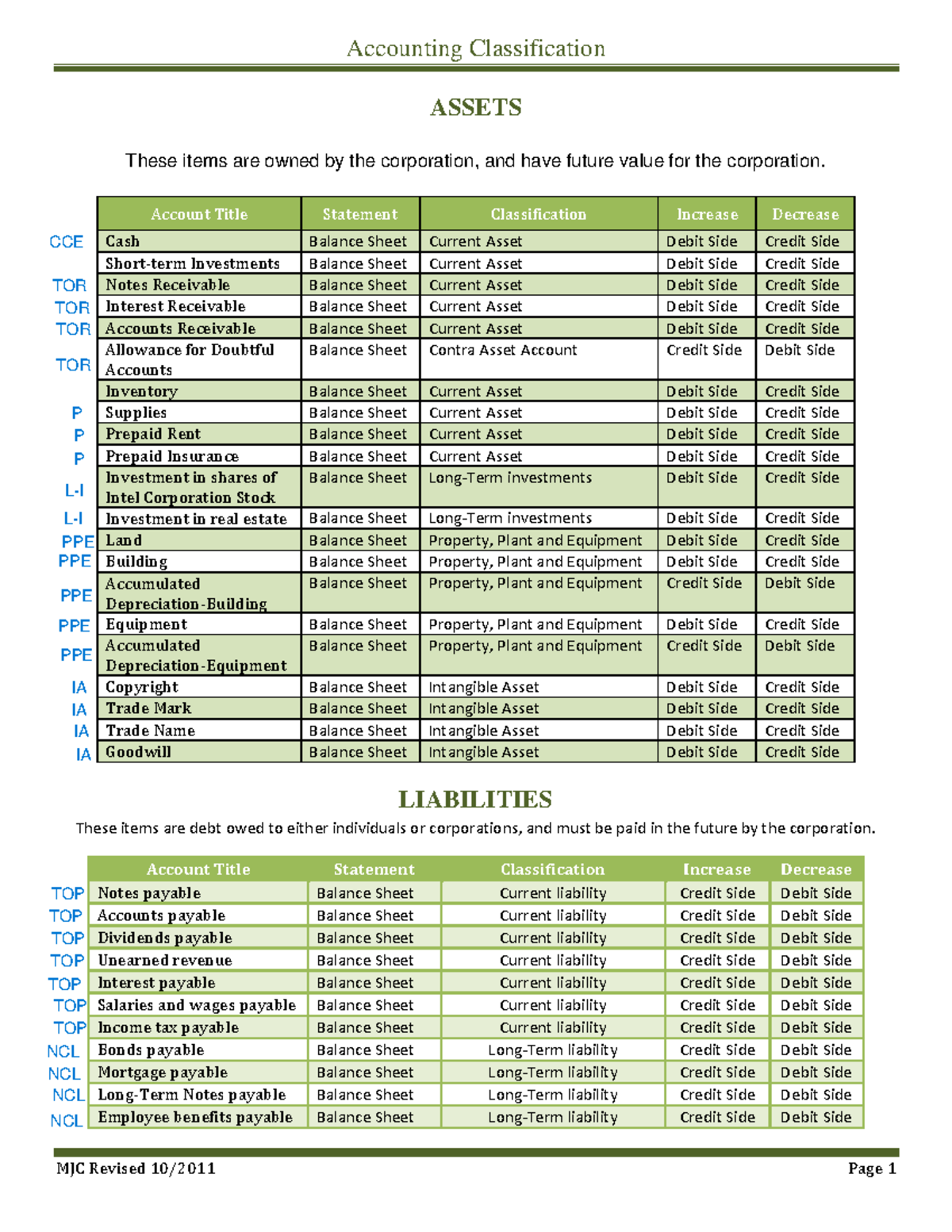

Examples of nominal accounts include sales account, purchases account, wages account, salaries account, interest account, rent account, gain on sale of fixed assets account and loss on sale of fixed assets account etc. In addition to current assets and long-term assets, the company tracks current and long-term liabilities. Current liabilities include accounts payable (amounts owed to vendors that have granted credit terms) and other payables like income tax, payroll taxes, and sales tax, as well as accruals such as wages payable. These current liabilities are those debts that must be paid within one year or within the normal operating cycle of the business. On the other hand, long term liabilities include long-term debt and other debts that are due in more than 12 months.

Part 2: Your Current Nest Egg

Any dividend received from oil company would be termed as dividend income rather than dividend revenue. Other examples of income include interest income, rent income and commission income etc. The businesses usually maintain separate accounts for revenues and all incomes earned by them. Let’s say that you sell $1000 worth of your inventory, money which you then place into your bank account. You would then simply increase (debit side) your bank account by $1000 and decrease (credit side) your Inventory account.

In corporate form of business withdrawals are more systematic and usually termed as distributions to stockholders. The account used for recording such distributions is known as dividend account. Therefore, these standards are not applicable to Micro, Small and Medium size Non-company entities.

Due to the fact that both internal and external users of accounting information rely on financial data, the accounts identified and the resulting rules applied should be accurate at all times. Representative personal accounts represent a certain person or a group. It is nearly impossible to provide a complete list of accounts therefore we tried to provide you depreciation tax shield depreciation tax shield in capital budgeting with the most often used accounts along with a general understanding of how similar types of accounts may look like. Consider the example of an employee whose wages are paid in advance to him/her, a prepaid wages account will be opened in the books of accounts. This wages prepaid account is a representative personal account indirectly linked to the person.

Getting familiar with how debits and credits affect the different types of real accounts is important. Liabilities are obligations or debts payable to outsiders or creditors. The title of a liability account usually ends with the word “payable”. Examples include accounts payable, bills payable, wages payable, interest payable, rent payable and loan payable etc.

These three elements are reported on the statement of financial position or balance sheet. Multiple types of companies like International Public companies, International Financial Reporting, and others are all related to GAAP. The methodologies that the executives can follow are Cash Basis, Accrual Basis, and the hybrid between the two. The advantage of proper financial accounting in a company is that it can enhance complete transparency.

Be the first to post a comment.