Periodic and perpetual inventory systems are different accounting methods for tracking inventory, although they can work in concert. Overall, the perpetual inventory system is superior because it tracks all data and transactions. However, with a perpetual system, you need to make more decisions to use it successfully. Since the specific identification method, identifies exactly which cost the purchase comes from it does not change under perpetual or periodic. Under the perpetual method, cost of goods sold is calculated and recorded with every sale.

Would you prefer to work with a financial professional remotely or in-person?

If there is excess quantity then that may either be wasted or due to time lag, lose its value or benefit. It also leads to blocked cash which may be used for other beneficial purpose. XThe periodic system can be used in small and retail businesses where the inventory quantity is generally high, but the value is on the lower side. The counting and tracking may be done either monthly, quarterly or annually and helps in keeping a steady and continuous record of the quantity of inventory with the company. It also increases the accounts receivable and cash based on the nature of the sale. Regardless of the system, Rider holds one piece of inventory with a cost of $260.

Less Control and Information

The purchase account will be reversed to zero alongside with previous month’s balance. The cost of goods sold will be calculated and recorded in the income statement. To ascertain the amount of inventory on hand and the cost of products sold, a corporation using a periodic inventory system physically counts the inventory after each period. Many businesses pick monthly, quarterly, or yearly intervals depending on their product demands and bookkeeping. LIFO means last-in, first-out, and refers to the value that businesses assign to stock when the last items they put into inventory are the first ones sold. The products in the ending inventory are either leftover from the beginning inventory or those the company purchased earlier in the period.

- This system allows the company to know exactly how much inventory they have at any specific time period.

- We are physically counting inventory only at the end of the period and reconciling that with the inventory recorded in the books.

- It’s interesting to note that the method is still widely used today, and many business owners prefer it to the perpetual inventory system.

- The growing use of cloud accounting software has made inventory tracking incredibly easy and cheap to implement.

- Regardless of the system, Rider holds one piece of inventory with a cost of $260.

Ask Any Financial Question

In a periodic FIFO inventory system, companies apply FIFO by starting with a physical inventory. In this example, let’s say the physical inventory counted 590 units of their product at the end of the period, or Jan. 31. In a periodic inventory system, you update the inventory balance once a period.

Periodic Vs Perpetual Inventory System

In this method, you calculate an average for the period instead of moving transactions over when the company bought or sold something during the period. Weighted average cost (WAC) in a periodic system is another cost flow assumption and uses an average to assign petty cash: what it is how it’s used and accounted for examples the ending inventory value. Using WAC assumes you value the inventory in stock somewhere between the oldest and newest products purchased or manufactured. Record sales discount by debiting the sales discount account and crediting the accounts receivable account.

This simplicity in use also makes the system more cost-effective, as it can be managed manually, and businesses won’t need to hire a trained bookkeeper or invest in expensive accounting software. That’s why, by comparison, the periodic inventory system is way more tiresome, time-consuming, and prone to error than the perpetual inventory, as everything is done manually. Merchandising businesses that deal with hundreds of transactions a day, such as grocery stores or pharmacies, can’t possibly maintain their inventory through a periodic inventory system. We are physically counting inventory only at the end of the period and reconciling that with the inventory recorded in the books.

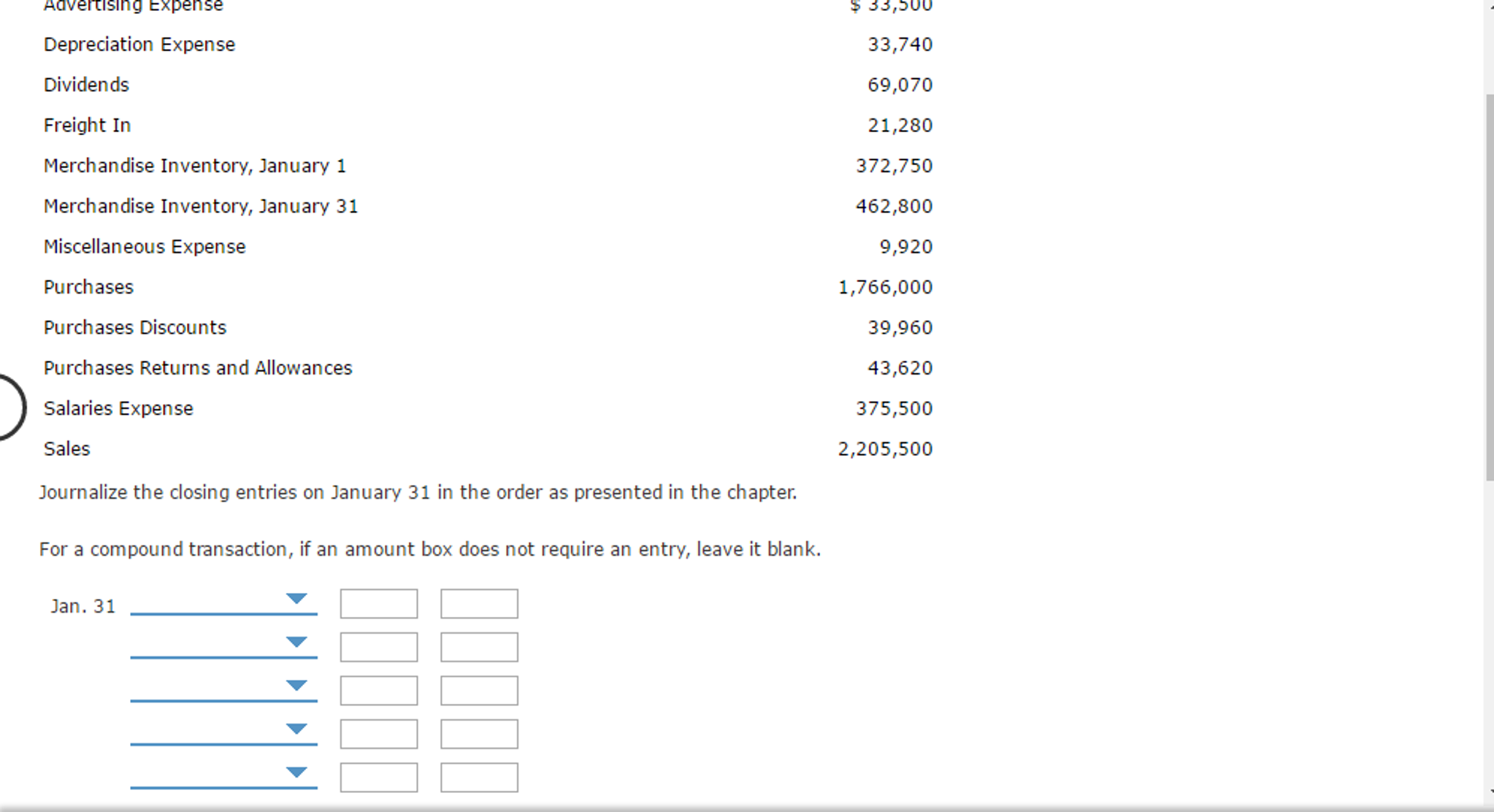

The debit, merchandise inventory (ending), is subtracted from that total to determine the balancing debit to the cost of goods sold. The cost of goods sold is then calculated by deducting the previously tallied ending inventory from the total price of the commodities offered. The second formula for calculating the Cost of Goods Sold (COGS) is the following. Not only must an adjustment to Merchandise Inventory occur at the end of a period, but closure of temporary merchandising accounts to prepare them for the next period is required. Temporary accounts requiring closure are Sales, Sales Discounts, Sales Returns and Allowances, and Cost of Goods Sold.

But task can become tedious ad complicated if the quantity of inventory is very high and it also involves may types of the same. There is also the possibility of error while counting, misplacement or theft leading to inaccuracy. Although this method requires one less entry, the cost of goods sold is not specifically determined.

Preparing financial statements under the periodic inventory system means calculating the cost of goods sold during the period and the ending inventory. The net sale will be recorded only $ 9,500 due to the discount while the accounts receivable increase only $ 9,500 too. Because these costs result from the acquisition of an asset that eventually becomes an expense when sold, they follow the same debit and credit rules as those accounts.

Be the first to post a comment.