In the problem above, identify a pair of projects that could suffer from the size problem, but not a reinvestment rate problem. Next, identify a pair of projects that could suffer from the reinvestment rate problem, but not the size problem. With two solutions, it is unclear whether to accept or reject the project, so we use NPV analysis instead. By doing your due diligence and crunching the numbers before moving forward with your next capital project, you can improve the chances your company makes the right moves. And when it boils down to it, that’s the best you and any stakeholders can hope for. Here, The IRR of Project A is 7.9% which is above the Threshold Rate of Return (We assume it is 7% in this case.) So, the company will accept the project.

- The present value of each cash inflow and outflow is calculated in column D (column B x column C).

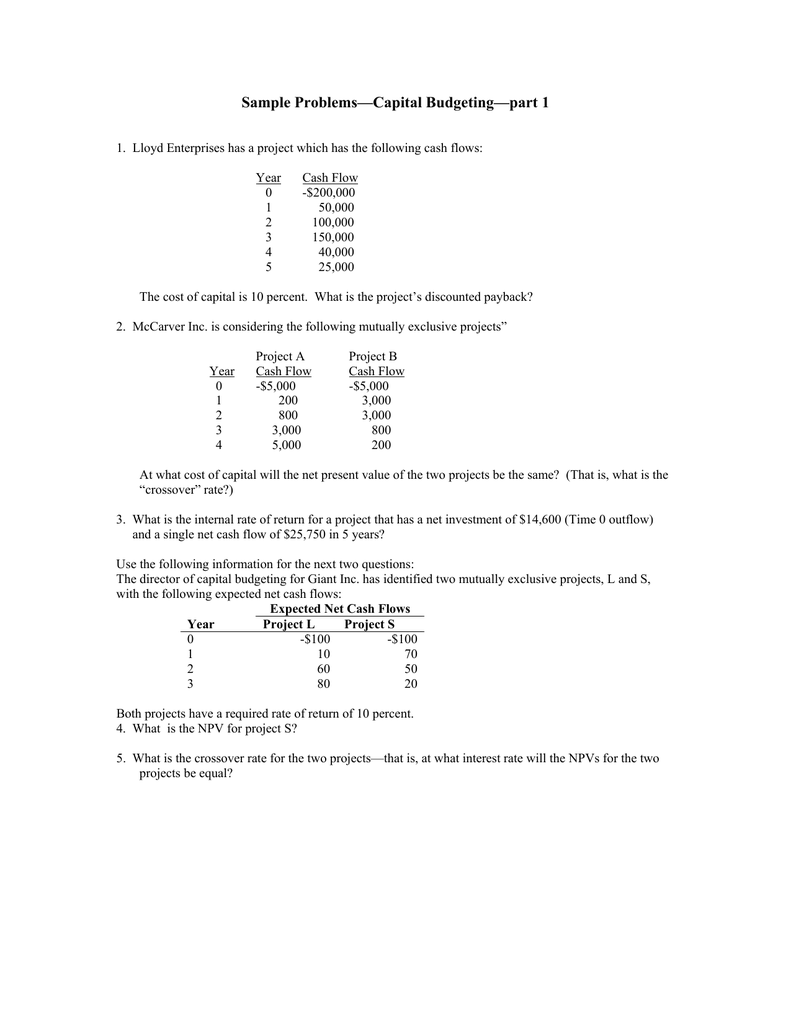

- Under certain conditions, the internal rate of return (IRR) and payback period (PB) methods are sometimes used instead of net present value (NPV) which is the most preferred method.

- Does this mean that their capital budgeting process is flawed?

Practice Video Problem 11-2: Net present value method LO6

Given what we know about the cash flow estimates above, we evaluate whether or not the project will help us add value for shareholders. The IRR of Project A is lower than that of Project B, no matter what the discount rate is. One unique feature about the NPV profile is that it visualizes how IRR is related to NPV. Recall that the IRR of this project is 16.65%, and that is the exact discount rate at which the profile line crosses the horizontal axis. In other words, IRR is in fact the discount rate that makes the project NPV to equal zero.

Challenges And Pitfalls In Capital Budgeting

For example, $1,000,000 paid today is intrinsically worth more than $1,000,000 payable at the end of the year. It helps the management for monitoring and containing the implementation of the proposals. The competent authority spends the money and implements the proposals. While implementing the proposals, assign responsibilities to the proposals, assign responsibilities for completing it, within the time allotted, and reduce the cost for this purpose.

Cash Flow

However, this contradicts the NPV ranking, which shows that project A is more preferable than project B. This is because the projects have different initial costs and discount rates, which affect the NPV calculation. To resolve this inconsistency, we can use the modified internal rate of return (MIRR), which assumes that the cash flows are reinvested at the cost of capital, rather than the IRR.

Why Is Capital Budgeting Important For Businesses?

It provides a better valuation alternative to the payback method, yet falls short on several key requirements. Another drawback is that both payback periods and discounted payback periods ignore the cash flows that occur toward the end of a project’s life, such as the salvage value. Discounted cash flow also incorporates the inflows and outflows of a project. Most often, companies may incur an initial cash outlay for a project (a one-time outflow). Other times, there may be a series of outflows that represent periodic project payments.

The more value the project generates, the more wealth is generated for our shareholders. When the discount rate increases, the NPVs from both projects decline. Make sure to plot discount rates on the x-axis and NPV on the y-axis. For the project in this example, NPV declines as discount rate increases. With that in mind, let’s take a look at some of the pros and cons of capital budgeting to help you figure out whether it makes sense for your business. When businesses are considering massive undertakings—like building a new facility or investing in expensive new equipment—they generally can’t just dip into their working capital to cover the costs.

The payback period is identified by dividing the initial investment in the project by the average yearly cash inflow that the project will generate. Capital budgeting is a process that businesses use to evaluate potential major projects or investments. Building a new plant or taking a large stake in an outside venture are examples of initiatives that typically require capital budgeting before they are approved or rejected by management. For example, a major reallocation of budget from strategic initiative to another in response to geo-political change should be evaluated and confirmed by all impacted area managers. The Diamond LX and VIP Express models have the same types of cash inflows/outflows–investment required, annual net cash inflows, and the salvage value at the end of the useful life. Inflation is an economic concept that measures the general increase in prices and the resulting decline in the purchasing value of money over a period of time.

Alternatively, a negative NPV indicates a company’s cash outflows over the life of a project exceed what it is expected to receive. When a project’s NPV is negative, the project is not profitable and should not be accepted for financial reasons. The IRR method is also problematic when the discount rate states with the highest sales tax rates in the usa of a project is not known. If the IRR is above the discount rate, the project is feasible. If a discount rate is not known, there is no benchmark to compare the project return against. In cases like this, the NPV method is superior as projects with a positive NPV are considered financially worthwhile.

They aren’t easy to predict, and businesses must always be aware of them to make smart investment decisions. Capital budgeting aids companies in choosing which major projects to fund. This decision-making process involves challenges and requires careful analysis. A financial advisor for budgeting can help spot these biases, providing an objective viewpoint that ensures investment decisions align with company goals. It helps spot and measure the different risks a project can face.

Be the first to post a comment.