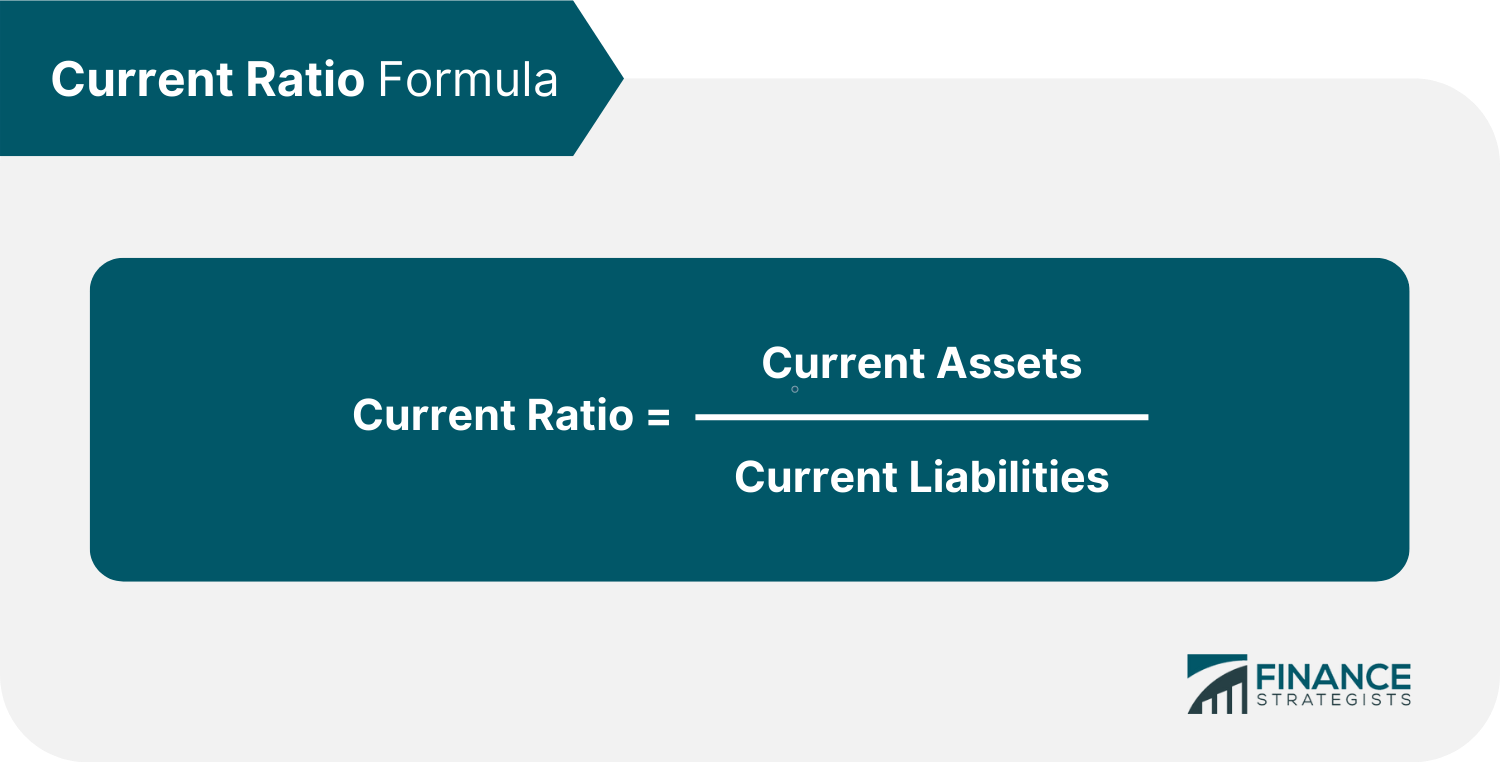

Large retailers can also minimize their inventory volume through an efficient supply chain, which makes their current assets shrink against current liabilities, resulting in a lower current ratio. However, because the current ratio at any one time is just a snapshot, it is usually not a complete representation of a company’s short-term liquidity or longer-term solvency. A well-managed business can increase credit sales and keep their accounts receivable balance at a reasonable level. If you can increase the turnover ratio, you’ll collect cash at a faster rate, and the company’s liquidity will improve. The current ratio describes the relationship between a company’s assets and liabilities.

When Analyzing a Company’s Current Ratio, What Factors Should Be Considered?

For example, let’s say that Company F is looking to obtain a loan from a bank. The bank may evaluate Company F’s current ratio to determine its ability to repay the loan. If Company F has a high current ratio, the bank may be more likely to extend credit, suggesting the company can meet its short-term obligations. Company C has a current ratio of 3, while Company D has a current ratio of 2.

Inventory Management Issues – Common Reasons for a Decrease in a Company’s Current Ratio

Such purchases require higher investments (generally financed by debt), increasing the current asset side. Various factors, such as changes in a company’s operations or economic conditions, can influence it. Monitoring a company’s Current Ratio over time helps in assessing its financial trajectory. For instance, if a company’s Current Ratio was 2 last year but is 1.5 this year, it may suggest that its liquidity has slightly decreased, which could be a cause for further investigation.

Great! The Financial Professional Will Get Back To You Soon.

Banks would prefer a current ratio of at least 1 or 2, so that all the current liabilities would be covered by the current assets. Since Charlie’s ratio is so low, it is unlikely that he will get approved for his loan. A low current ratio may indicate the company is not able to cover its current liabilities without having to sell its investments or delay payment on its own debts. For example, if a company’s current assets are $80,000 and its current liabilities are $64,000, its current ratio is 125%.

Create a Free Account and Ask Any Financial Question

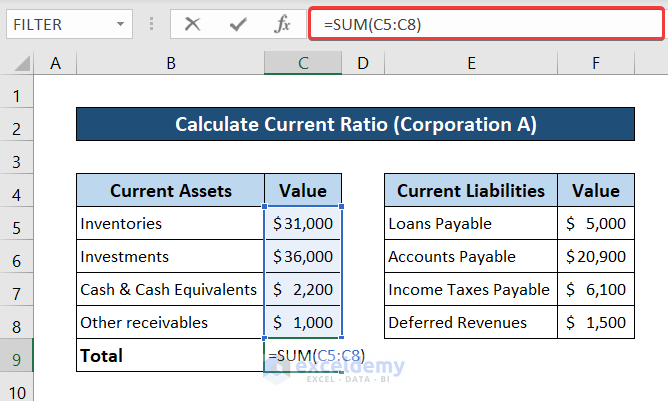

Business owners must focus on working capital, liquidity, and solvency so that their business can generate enough cash to operate. Managers should also monitor liquidity and solvency, and there are three additional ratios that can help you get the job done. Once you have determined your asset and liability totals, calculating the current ratio in Excel is very straightforward, even without a template. The current ratio is part of what you need to understand when investing in individual stocks, but those investing in mutual funds or exchange-trade funds needn’t worry about it. The offers that appear on this site are from companies that compensate us.

We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service.

At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content. Over-trading companies are likely to face substantial difficulties in meeting their day-to-day obligations.

- Imagine it as a financial health checkup for a business, telling us whether it’s equipped to handle its immediate financial responsibilities or if it might be struggling to meet its short-term obligations.

- This means that Company A has $2 in current assets for every $1 in current liabilities, indicating that it can pay its short-term debts and obligations.

- Outfield’s current assets include cash, accounts receivable, and inventory totalling $140,000.

- In such cases, acid-test ratios are used because they subtract inventory from asset calculations to calculate immediate liquidity.

In this example, although both companies seem similar, Company B is likely in a more liquid and solvent position. An investor can dig deeper into the details of a current ratio comparison by evaluating other liquidity ratios that are more narrowly focused than the current ratio. For example, in one industry, it may be more typical to extend credit to clients for 90 days or longer, while in another industry, short-term collections are more critical. Ironically, the industry that extends more credit actually may have a superficially stronger current ratio because its current assets would be higher. Finally, the operating cash flow ratio compares a company’s active cash flow from operating activities (CFO) to its current liabilities. This allows a company to better gauge funding capabilities by omitting implications created by accounting entries.

Learn how to build, read, and use financial statements for your business so you can make more informed decisions. To compare the current ratio of two companies, it is necessary that both of them use the same inventory valuation method. For example, comparing current ratio of two companies would be like comparing apples with oranges if one uses FIFO while other uses LIFO cost flow assumption for costing/valuing their inventories. The analyst would, therefore, not be able to compare the ratio of two companies even in the same industry.

Generating net income and issuing stock both increase the equity balance. If your business pays a dividend to owners or generates a net loss, equity is decreased. Andy Smith is a Certified Financial Planner (CFP®), licensed realtor and educator with over 35 years of diverse financial management experience. He is an expert on personal finance, corporate finance and real estate and has assisted thousands of clients in meeting their financial goals over his career.

Companies may attempt to manipulate their current ratio to give investors or lenders a clearer picture of their financial health. This is because inventory can be more challenging to convert into cash quickly than other current assets and may be subject to write-downs or obsolescence. Inventory management issues can also lead to a decrease in the current ratio. If the company holds too much crossword clue: single entry in a list crossword solver inventory that is not selling, it can tie up cash and reduce the current ratio. For example, a company with a high proportion of short-term debt may have lower liquidity than a company with a high proportion of accounts payable. Finally, we’ll answer some frequently asked questions, including what happens if the current ratio is too high and whether the current ratio can be manipulated.

Be the first to post a comment.