The D/E ratio is a powerful indicator of a company’s financial stability and risk profile. It reflects the relative proportions of debt and equity a company uses to xero for dummies cheat sheet finance its assets and operations. The data required to compute the debt-to-equity (D/E) ratio is typically available on a publicly traded company’s balance sheet.

Debt to Equity Ratio Explained

Laura started her career in Finance a decade ago and provides strategic financial management consulting. Monica Greer holds a PhD in economics, a Master’s in economics, and a Bachelor’s in finance. She is currently a senior quantitative analyst and has published two books on cost modeling. InvestingPro offers detailed insights into companies’ D/E Ratio including sector benchmarks and competitor analysis. There is no universally agreed upon “ideal” D/E ratio, though generally, investors want it to be 2 or lower. The D/E ratio is much more meaningful when examined in context alongside other factors.

Exact Formula in the ReadyRatios Analysis Software

Because equity is equal to assets minus liabilities, the company’s equity would be $800,000. Its D/E ratio would therefore be $1.2 million divided by $800,000, or 1.5. If interest rates are higher when the long-term debt comes due and needs to be refinanced, then interest expense will rise. To get a clearer picture and facilitate comparisons, analysts and investors will often modify the D/E ratio. They also assess the D/E ratio in the context of short-term leverage ratios, profitability, and growth expectations.

Get in Touch With a Financial Advisor

- A low D/E ratio shows a lower amount of financing by debt from lenders compared to the funding by equity from shareholders.

- That is, total assets must equal liabilities + shareholders’ equity since everything that the firm owns must be purchased by either debt or equity.

- Over time, the cost of debt financing is usually lower than the cost of equity financing.

- In this situation, the debt-to-equity ratio would not be meaningful because the denominator (equity) is negative.

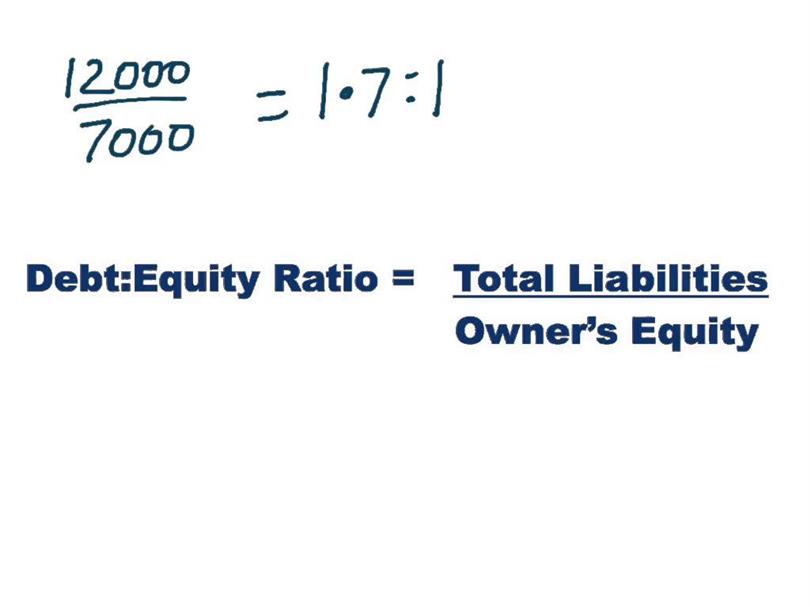

The debt-to-equity (D/E) ratio is used to evaluate a company’s financial leverage and is calculated by dividing a company’s total liabilities by its shareholder equity. It is a measure of the degree to which a company is financing its operations with debt rather than its own resources. One of the most important measures to be used in assessing the company’s financial structure is the debt-to-asset ratio. This gives an indication of whether a business has adequate assets to service its liabilities, thereby offering insights into stability and risk. It is one of the keys to making strategic decisions in financing, debt management, and the expansion of operations to businesses. For stakeholders, the level of risk involved in investing or lending to a company also needs to be evaluated.

Personal Loans

The formula for calculating the debt-to-equity ratio (D/E) is equal to the total debt divided by total shareholders equity. In some cases, companies can manipulate assets and liabilities to produce debt-to-equity ratios that are more favorable. If they’re low, it can make sense for companies to borrow more, which can inflate the debt-to-equity ratio, but may not actually be an indicator of bad tidings. If preferred stock appears on the debt side of the equation, a company’s debt-to-equity ratio may look riskier. Banks and other lenders keep tabs on what healthy debt-to-equity ratios look like in a given industry. A debt-to-equity ratio that seems too high, especially compared to a company’s peers, might signal to potential lenders that the company isn’t in a good position to repay the debt.

Great! The Financial Professional Will Get Back To You Soon.

Gearing ratios focus more heavily on the concept of leverage than other ratios used in accounting or investment analysis. The underlying principle generally assumes that some leverage is good, but that too much places an organization at risk. Average values for the ratio can be found in our industry benchmarking reference book – debt-to-equity ratio. Currency fluctuations can affect the ratio for companies operating in multiple countries. It’s advisable to consider currency-adjusted figures for a more accurate assessment. Here, “Total Debt” includes both short-term and long-term liabilities, while “Total Shareholders’ Equity” refers to the ownership interest in the company.

For example, if a company takes on a lot of debt and then grows very quickly, its earnings could rise quickly as well. If earnings outstrip the cost of the debt, which includes interest payments, a company’s shareholders can benefit and stock prices may go up. A debt-to-equity-ratio that’s high compared to others in a company’s given industry may indicate that that company is overleveraged and in a precarious position.

Therefore, comparing D/E ratios across different industries should be done with caution, as what is normal in one sector may not be in another. Let’s examine a hypothetical company’s balance sheet to illustrate this calculation. Understanding these distinctions is crucial for accurately interpreting a company’s financial obligations and overall leverage.

Be the first to post a comment.